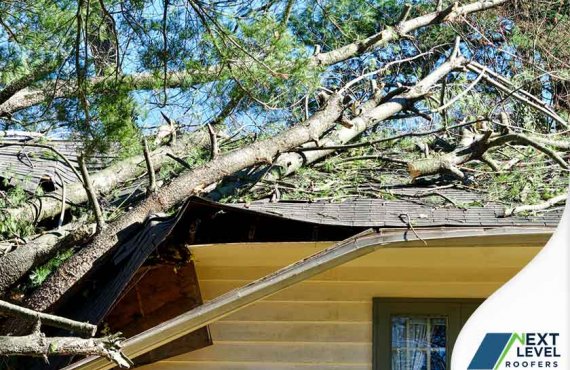

The better and smarter solution to an old and failing roof is a complete replacement. But given how a roof replacement is a major undertaking, some homeowners would try to put off the project–which might be a bad idea. When your roofing problems remain overlooked, they can only result in further damage, and this, in turn, leads to more expenses. The good news is that there are many roof financing options available to you. They offer a simple and convenient way to pay for your roof upgrade. You just need to choose the one that best works for your current needs and circumstances.

Next Level Roofers, the premier residential roofing company in the area, shares some of the essentials you should consider when selecting a roof financing option:

Fees

Roof financing programs usually have hidden numbers in the fine print. These may include different types of fees, such as the origination fee, which you’ll be required to pay when taking out a loan. The origination fee is typically paid at the beginning of the transaction and is almost always a one-time payment.

You should also look out for late payment fees, which may be issued when a monthly or annual payment is overdue. There’s even an early repayment fee, a charge you’ll need to pay should you decide to settle your loan before the end of the term. Next Level Roofers, one of the trusted roofing companies in the area, recommends you check with the loan service provider and get all the pertinent information so you can prevent different fees from piling up.

Terms

The term refers to the duration of your loan. Should you choose a financing program with a longer-term, you’ll need to pay more interest over the course of the loan. But this also means smaller monthly payments. Choosing a financing option with a shorter term, on the other hand, means you should expect higher monthly payments–but this allows you to pay back your loan much more quickly. It pays to read the details of your potential roof financing program front to back so you’ll have a clearer idea about it.

Interest Rates

Make sure to take interest rates into account when comparing different roof financing programs. That’s because you’ll be paying back not only the amount you borrowed but also the interest it accumulates over time. In fact, the amount you’ll need to pay based on the original sum you’ve borrowed will be determined by the interest rate. Another thing–your credit score, bank, and financial profile can influence your interest rate. You may get a lower one for your roof replacement if you’ve maintained a good credit score and have a stable source of income.

Monthly Payment and Extra Benefits

You should consider a roof financing option that offers monthly payments you can easily afford. The loan may have a longer-term, but at least the lower monthly payments can fit your current budget. And when picking a financing program, you should check for additional benefits. For instance, those who are a member of a local credit union or a bank are sometimes offered an interest rate discount. If you sign up with auto-pay, it’s possible to get a rebate, as well. And if you’re paying for a smaller roof upgrade using a credit card, you may be qualified for a significant cash-back or travel rewards.

Different Roof Financing Options

There are many ways to pay off a complete roof replacement, including:

- Cash. It’s actually a good idea to save and pay for your roof with the cash you have on hand. Paying with cash is fast and easy, mostly because you won’t need to get a loan or worry about interest rates. The drawback, however, is that it’s not easy to keep that kind of money out-of-pocket, especially when you need to use it for a major home upgrade like a roof replacement.

- Home Equity Loan. This particular option is a loan for a fixed amount of money that’s secured by your home. Home equity works much like a mortgage–you’ll need to repay the loan with a fixed amount over a set term. This financing program is extremely useful if you want a non-variable and predictable payment schedule. But because the collateral for the loan is your home, the lender can foreclose your home if you miss payments.

- Credit Card. Putting your roof replacement on a credit card can be a good idea, especially if the card comes with generous rewards and incentives. However, using it means having to pay off high-interest rates, along with the processing fees charged to the roofing contractor when they run your payment. These transaction fees will almost always be passed on to you.

Exceptional Financing Option from Next Level Roofers

As far as your options go, you can do better, so why not work with roofers who can offer you a more flexible and stress-free financing program. In this area, that will be Next Level Roofers. We work with multiple lenders so you have access to convenient financing options that can fit your budget. When you choose us, you can benefit from these great features (some of which may be subject to credit approval):

- Instant decisions

- Annual percentage rate starting at 4.99%

- Deferred interest offers

- Unsecured loan terms from 3 to 12 years

- No prepayment penalties

More Reasons to Work with Next Level Roofers

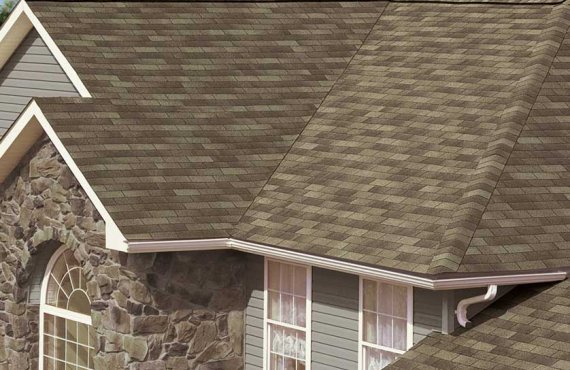

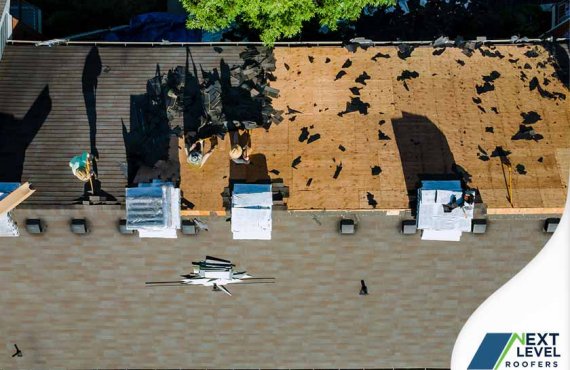

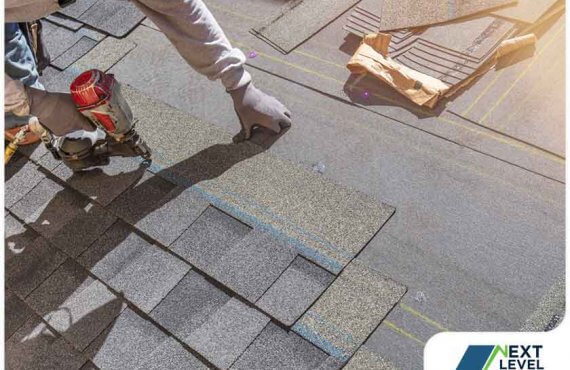

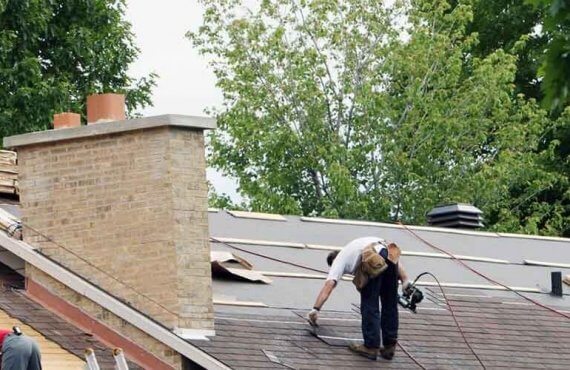

Once you choose one of our flexible financing options, it’s time to get started on your roof replacement. For South Florida homeowners, the name to call is Next Level Roofers. We are the go-to company for the highest quality residential roofing services, whether it’s new roof construction or shingle roof replacement. Working with us means working with a company that is:

- Credentialed. We have all the necessary licenses, bonds and insurance, including workers’ compensation and liability coverage, for your greater protection.

- Reputable. Next Level Roofers takes pride in the fact that we remain one of the most trusted roofing companies in the area. We make this possible through personalized customer service and exceptional workmanship backed by vast industry experience. The 5-star reviews we’ve earned in Google My Business and Facebook, along with our A Rating from the Better Business Bureau® speak about the quality of our work.

- Experienced. With over 39 years of combined industry experience, Next Level Roofers ensures a safer and smoother roof replacement process. When you turn to us for this upgrade, you can always expect the project to be finished perfectly right the first time. No costly mistakes and no callbacks–only complete client satisfaction.

- Certified. Next Level Roofers is a GAF® Certified Master Elite® roofing company, allowing access to top-tier asphalt shingle roofing systems and the solid warranty coverage included with them.

When in need of quality roof financing, look no further than the leading roofers in the area, Next Level Roofers. With our options, you’ll be able to invest in your roofing upgrade with greater confidence. We serve Orlando, FL plus the areas in the Villages and Sumter County. Call us today at (407) 237-7960 or fill out this contact form to schedule your roof evaluation.